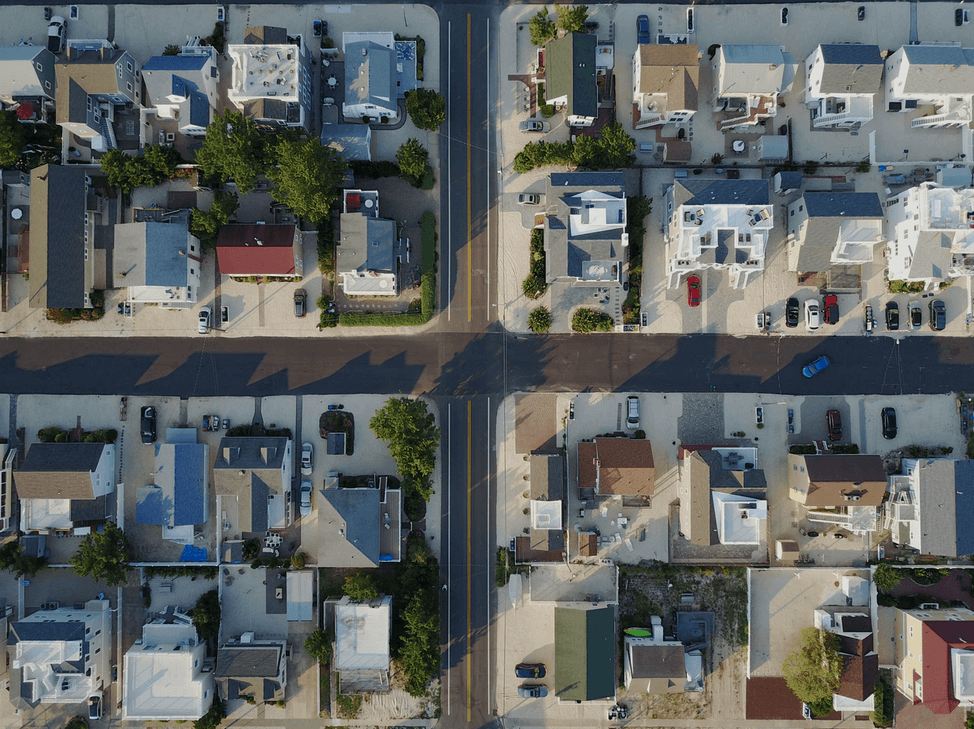

Up until 9 months ago when the Coronavirus (COVID-19) officially impacted the United States, commercial real estate investors were experiencing one of the hottest markets. Urban areas were seeing some of the highest prices in history.

Seemingly overnight investors could no longer visit their replacement properties, banks pulled out of loans, & rental properties realized cancellations.

The new reality is, it is unlikely investors will find a replacement property. Exchangers who sell their relinquished property do not have the luxury of “sitting it out” to wait for a better opportunity given the 45-Day ID period. What is an investor to do?

All too often we see clients enter the exchange process with the intent of sourcing a property within the 45-Day identification period, then due to the competitive and now uncertain market, along with limited inventory, either settle for a sub-par property or opt to pay the tax. Our recommendation is almost always to identify and gain control of your replacement property ahead of time or identify a secure backup property.

Enter the Concept of Utilizing Delaware Statutory Trusts (DST’s): DST’s offer 1031 Exchange investors a potential insurance policy; a way to guarantee 100% of their exchange funds are invested in a replacement property rather than taxed for Capital Gains. DST-owned real-estate is approved by the IRS as replacement property for 1031 Exchange purposes-however within this application, what truly sets DST ownership apart is that the real-estate can be identified and closed on in a matter of days, assuming the acquisition is suitable for the investor. The closing process does not contain any “contingencies” as the underlying property within the trust as well as the financing and tenanting are already secured, thus the property begins its cash flow potential from the day of the closing. It is also a way for multiple buyers to co-own high quality commercial real estate—fitting any investment level to the penny and in a way that is recession resilient, requires low minimums, and is fully managed.

Identifying a DST can help alleviate the timing pressure that can force an investor into making poor replacement property decisions or, even worse, paying considerable tax (capital gains, depreciation recapture, Obamacare tax) upon the sale.

Contact us today to learn more about DST’s and how they can be utilized as either “Exchange Insurance” or outright identified replacement property.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. DST 1031 properties are only available to accredited investors (typically defined as having $1 Million in net-worth excluding the primary residence or $200,000 income individually/ $300,000 jointly over the last three years) and accredited entity please verify with your CPA and attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies, and illiquidity. Because investors’ situations and objectives vary this information is not intended to indicate suitability for any investor in particular. This material is not to be interpreted as tax or legal advice. Please speak with your tax and legal advisors for advice/guidance regarding your situation.

Safe Harbor Asset Management and it’s subsidiary dba 1031 Investment Property Solutions is a fee-only SEC Registered Investment Advisory firm and does not accept commissions. We strictly adhere to the fiduciary standard of practice.

0 comments